Vineyard estates in famous wine producing areas are becoming increasingly popular investments

Christie's International Real Estate Affiliates, from some of the most famous wine producing areas, comment on their local markets

Owning a vineyard has long been regarded as a status symbol by international property investors, and demand for vineyard estates has been growing strong. Lately, more buyers have been drawn to the attractive lifestyle that a vineyard offers, the excitement of producing their own wine, and the opportunity to use the location to entertain guests in beautiful private premises. Apart from the aesthetic pleasure of owning a vineyard, there is also a strong investment potential.

Christie’s International Real Estate is affiliated with some of the most established international brokers in the world who can offer expert advice on the best vineyard options available around the globe. Buying a vineyard is a complex decision and potential buyers need the right guidance from fully qualified vineyard experts who can advise them on the quality and analysis of soil, tax issues, age and condition of the vines, as well as wine-making techniques.

In the world-renowned wine making region of Bordeaux, France, Michael Baynes, Managing Director at Maxwell-Storrie-Baynes, exclusive Affiliate in Bordeaux, says, “Our reputation in the local market is such that we have attracted some of the most competent advisors in the sector, willing to work closely with clients and ensure all investigations are completed thoroughly. A chateau with a vineyard that produces a regional Bordeaux appellation wine in the Entre-Deux-Mers region of southwestern France would sell for about €12,000– €15,000 per hectare. Today, vineyards are selling for €15,000–€25,000 a hectare, which probably sold for €25,000–€40,000 a hectare 10 years ago in the Bordeaux right bank outside of the appellations of St Emilion, Pomerol, and their satellites.”

Further south in Tuscany, Marta Romolini of Broker Immobiliare, exclusive Affiliate in Tuscany Italy, says, “At the moment, interest in Tuscan vineyards is mainly from international buyers, particularly investors from China and Russia. They are mostly attracted by the quality of the Tuscan wine, focusing their interest on famous labels such as Chianti. More often they are after a combination of both exemplary Tuscan architecture and wine production. For instance, we recently had an enquiry from a Russian buyer looking to purchase a villa with frescoes and a vineyard. The most focused buyers are usually looking to purchase a vineyard as an investment and also to import the wines to their country. For those with lower budgets (which I would say would be below five million Euros), vineyards are considered a bonus with the purchase of a villa, with the ability for family and friends to enjoy their own wine.”

Over the last few years the UK has been attracting increasingly more attention to its local wine production. Andrew Thomas from Strutt & Parker comments on the state of the vineyard market. "Britain’s viticulture industry is unrecognisable compared to just 10 or 20 years ago. Back then, there were no serious commercial growers and the few that did invest planted the wrong varieties in the wrong locations. The chalky hills of Kent, Sussex & Hampshire in the South of England share the same geology & climate as the Champagne Region of France but only now has Britain obtained the knowledge and expertise to fully understand and exploit its growing potential."

"We recently sold 90 acres of bare arable land in Kent and expected to see the usual London based investors. However we experienced interest from far afield as China and the land was finally sold to a French vineyard who are intending to grow sparkling wine. Three particular vines Pinot Noir, Chardonnay and Pinot Meunier enjoy the chalky soils and fair maritime climate of Kent. I predict that it won’t be long before Britain is well known internationally for having a handful of some of the largest and best sparkling wine products to rival some of the best in the World."

California benefiting from year-round pleasant weather conditions still remains one of the top choices for owning a vineyard estate. “In the Napa Valley and northern Sonoma, home buyers are still in a strong position due to the fall in house prices, however market forces are the opposite in the vineyard sector as vineyards cost $75,000–$300,000 per acre,” says William Densberger from Pacific Union International. “To get your Napa Valley vineyard off the ground, expect to pay development costs of about £30,000–$60,000 per acre and annual management costs of $5,000–$10,000 per acre with an acre producing between one to six tons of grapes. Vineyard owners and sellers maintain a strong position as it relates to higher-end vineyard and grape sales due to the well-documented shortage of premium and super-premium grape varietals and shrinking finished wine inventories. Favorable growing conditions (through mid August) in 2012 have both growers and winemakers optimistic of an exceptional year for quality, and a good year as it relates to quantity, especially after back-to-back short crop seasons. Luxury estates with larger vineyard components have multiple and sometimes competing market forces at work.”

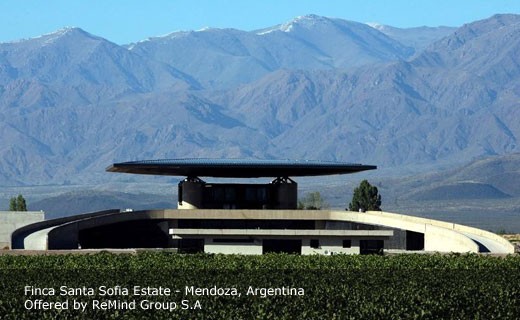

"The traditional vineyard market in Argentina is as strong as usual", says Guillermo Troglia from ReMind Group S.A exclusive Affiliate in Argentina. "The investment has been huge in the past ten years, with many international groups investing heavily in

Liên hệ

Antonia Koumantaropoulou - akoumantaropoulou@christies.comFor more news from Christie’s International Real Estate, visit our Press Center »

.svg&option=N&w={0}&permitphotoenlargement=false&fallbackimageurl=https%3A%2F%2Fcire-staging.gabriels.net%2Fresources%2F_responsive%2Fimages%2Fcommon%2Fnophoto%2Fdefault.jpg)